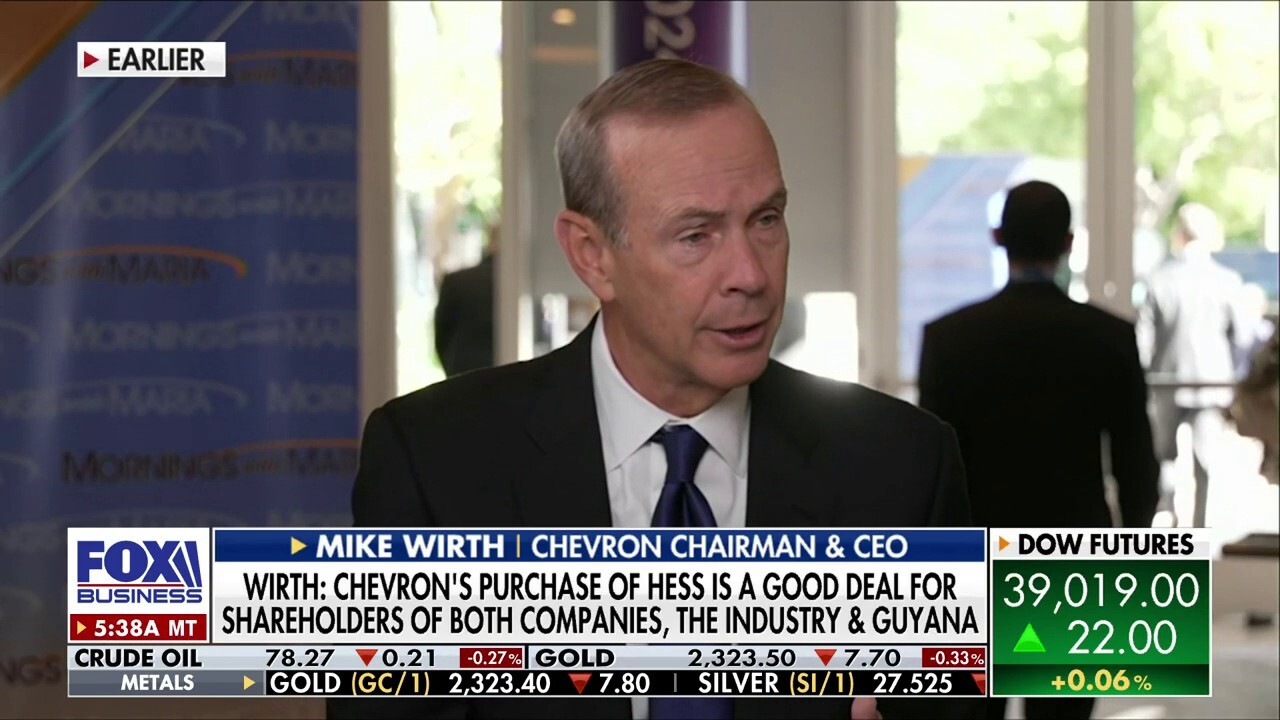

Chevron CEO reveals when US will see the 'end of the oil age'

CEO Mike Wirth says Chevron prepared for volatility with 'strong' oil demand growth

The 'end of the oil age' is not yet upon us: Chevron CEO Mike Wirth

Chevron Chairman and CEO Mike Wirth talks the Hess purchase, latest earnings, new oil production projects and the future of the natural gas market in a wide-ranging interview on 'Mornings with Maria.'

When it comes to America’s oil use and production, one major producer signaled that market uncertainty can’t pump the pipeline brakes.

"Markets are relatively balanced. Demand growth is strong. Last year was all-time record demand. We'll see demand grow again this year," Chevron CEO Mike Wirth said Tuesday on "Mornings with Maria." "So, the end of the oil age is not yet upon us."

Wirth spoke with host Maria Bartiromo at the 27th annual Milken Institute Global Conference, where he detailed expectations for positive financial performance and increased oil production through the rest of the year.

Gas prices have risen by a few cents, on average, in recent weeks. AAA reported the national average price for last week was $3.67 per gallon, 14 cents higher than this time last month and eight cents more than last year.

LARRY KUDLOW: WHY WON'T BIDEN ENFORCE SANCTIONS AGAINST IRANIAN OIL?

That same week, gas demand rose from 8.42 million barrels per day to 8.62 million barrels per day, data from the Energy Information Administration found.

Chevron CEO Mike Wirth on Tuesday said "the end of the oil age is not yet upon us" on "Mornings with Maria." (Fox News)

"It's important that we continue to meet that with new production, which is certainly what we've been doing," Wirth said.

"In the short term, these risks due to geopolitical events," like the Russia-Ukraine, Israel-Hamas and Red Sea conflicts, respectively, "are things to pay attention to because they could impact markets."

Biden energy policies restrict oil market's 'future investment, supply': Mike Wirth

Chevron Chairman and CEO Mike Wirth on the company's acquisition of Hess, Biden policy and growing oil demand and reliability.

"We did see some impact on our supply of natural gas into Israel during the early days of the conflict," he expanded. "We now have both platforms online and are meeting all the needs not only for Israel's domestic market, but also for Jordan and Egypt, where the gas goes as well… the risks in a situation like this are that, through some sort of an escalation [or] miscalculation, you could see impacts on physical supply in an area that supplies so much of the world's oil. And that's a real concern."

GET FOX BUSINESS ON THE GO BY CLICKING HERE

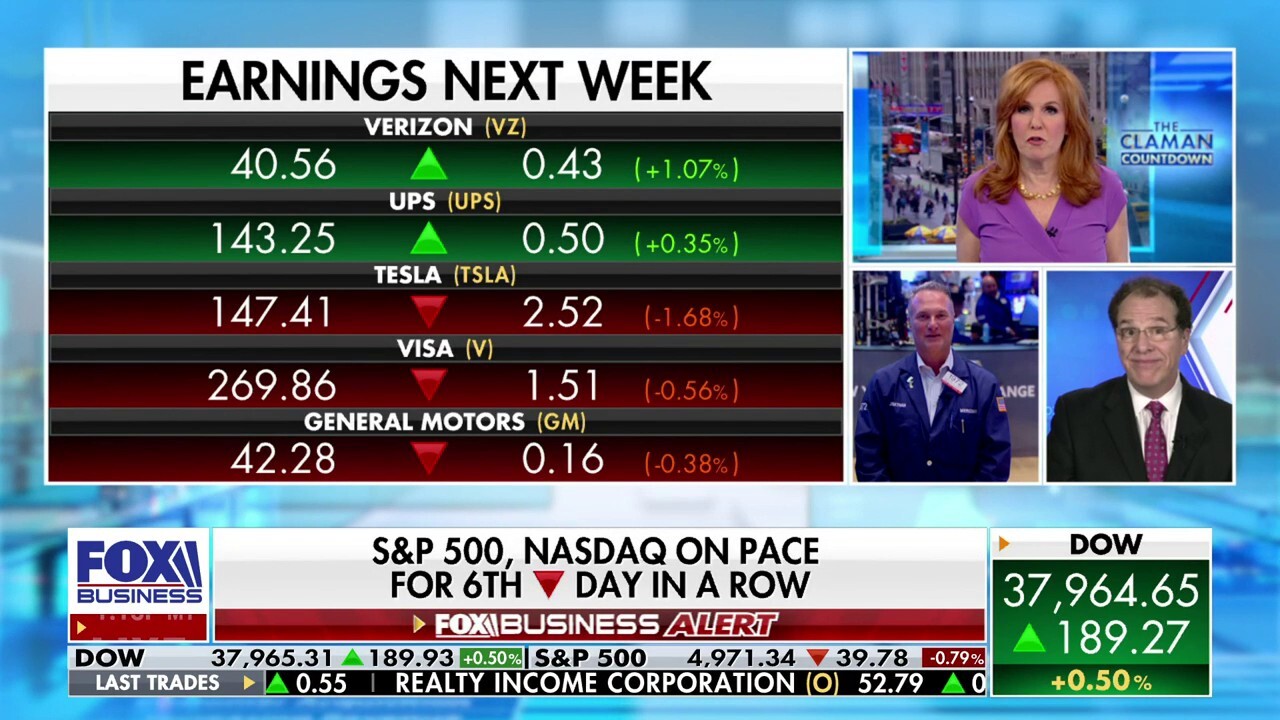

The oil market could explode at any moment: Phil Flynn

'The Claman Countdown' panelists Jonathan Corpina and Phil Flynn discuss interest rates, trading and commodities.

By preparing for this "volatility" with a balance sheet that can withstand an extended period of "very low prices," Chevron’s CEO noted that the company predicts it will deliver 10% compound annual growth in free cash flow over the next several years.

"Driven by the Permian, driven by some other shale assets in our portfolio, projects in the deepwater Gulf of Mexico," Wirth pointed out, "we've got a number of other assets that are delivering growth. And the combination with Hess only strengthens our cash flow longer into the future, not only to the end of this decade, but well into the next."

FOX Business’ Christopher Murray contributed to this report.