Home Depot DIY customers and pro shoppers more cautious

Sales at US stores open for at least a year fell 4.6%

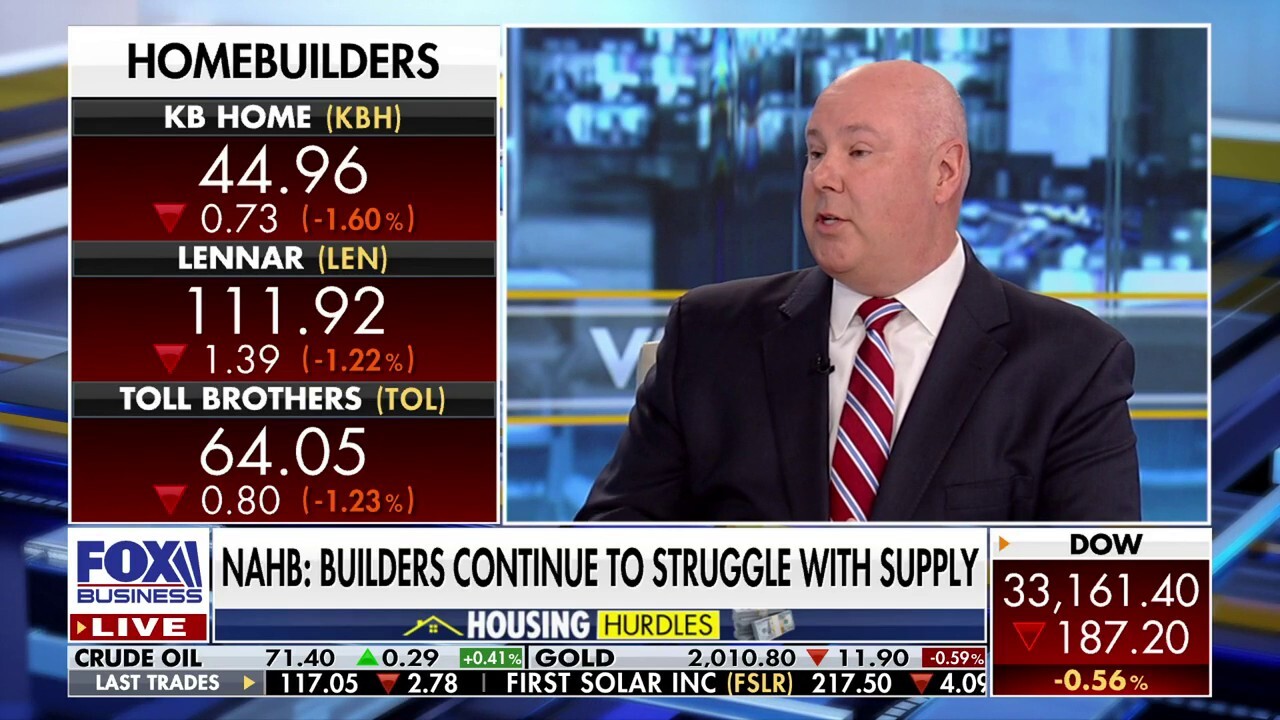

Homebuilders continue to struggle with supply: Jim Tobin

NAHB CEO Jim Tobin discusses three ways to increase supply of new homes.

Shares of Home Depot sank after the company missed revenue expectations and lowered its profit and sales outlook for the year as the home retailer moves into a new normal.

There is a "more cautious consumer, given the broader macro concerns, including credit availability," said CEO Ted Decker. Its pro customer is "taking on smaller, less discretionary projects," he added. Sales at U.S. stores open for at least a year fell 4.6%.

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| HD | THE HOME DEPOT INC. | 381.00 | -4.15 | -1.08% |

| I:DJI | DOW JONES AVERAGES | 50135.87 | +20.20 | +0.04% |

| LOW | LOWE'S COMPANIES INC. | 276.89 | -1.49 | -0.54% |

The headwinds are an about-face from when the home improvement company faced three years of "unprecedented growth" during the pandemic.

Revenue fell to $37.3 billion during the three-month period ending April 30, which is a drop of 4.2% from the same period a year ago. The figure fell short of the $38.45 billion that was projected by analysts polled by Zacks Investment Research.

HOME DEPOT WARNS OF WEAK 2023 PROFIT AS RISING PRICES HURT DEMAND

Home Depot

Decker blamed the weaker sales on lumber deflation and poor weather, in particular in its Western division "as extreme weather in California disproportionately impacted our results."

In an aerial view, a sign is seen posted on the exterior of a Home Depot store on Feb. 21, 2023 in El Cerrito, California. ( Justin Sullivan/Getty Images / Getty Images)

However, Home Depot expected that the fiscal year 2023 would be a year of moderation after three years of exceptional growth in which the company's sales grew by $47 billion.

Decker told analysts on an earnings call Tuesday that the company grew "disproportionally" during that time as consumers shifted their spending habits into home improvement.

"Undoubtedly, after that period of growth, you're going to see moderation, which is exactly what we saw" in the first quarter, he said.

HOME DEPOT BOOSTS PAY FOR HOURLY WORKERS

The company still believes the consumer is "relatively strong, as evidenced by continued increases in personal consumption," according to Decker.

However, there has been "an accelerated shift out of goods to service spending as the broader economy has gotten back to normal, and that's in particular at home improvement…people aren't spending all of their time at home as they did in the prior few years," Decker said.

A Home Depot store in Hyattsville, Maryland, on Thursday, Nov. 10, 2022. Home Depot Inc. is scheduled to release earnings figures on November 15. ( Sarah Silbiger/Bloomberg via Getty Images / Getty Images)

GET FOX BUSINESS ON THE GO BY CLICKING HERE

Home Depot Inc. now expects sales and same-store sales to decline between 2% and 5% this year. Several months ago, the company said it expected sales to be flat compared with 2022.

Full-year earnings are projected to fall between 7% and 13%, expanding the potential decline from earlier expectations that the retreat would remain solidly in the single-digit percentage range.

The Associated Press contributed to this report.