Advent to buy Maxar Technologies for about $4B

Including debt, the transaction is worth $6.4 billion

Maxar Technologies CEO on space infrastructure

Maxar Technologies President and CEO Daniel Jablonsky discusses innovation in space.

Advent International agreed to buy Maxar Technologies Inc. in a deal that values the satellite owner and operator at about $4 billion.

Advent is paying $53 a share for Maxar, the companies said, confirming an earlier Wall Street Journal report. Shares of Maxar, down 23.5% since the beginning of the year, closed at $23.10 on Thursday. They soared 120% pre-market on the news.

Including debt, the transaction is worth $6.4 billion, making it one of the bigger buyouts to be announced during the past few months, when market turmoil and a challenging financing environment have made it harder to do deals. The debt for the transaction will be supplied by a group of nonbank lenders.

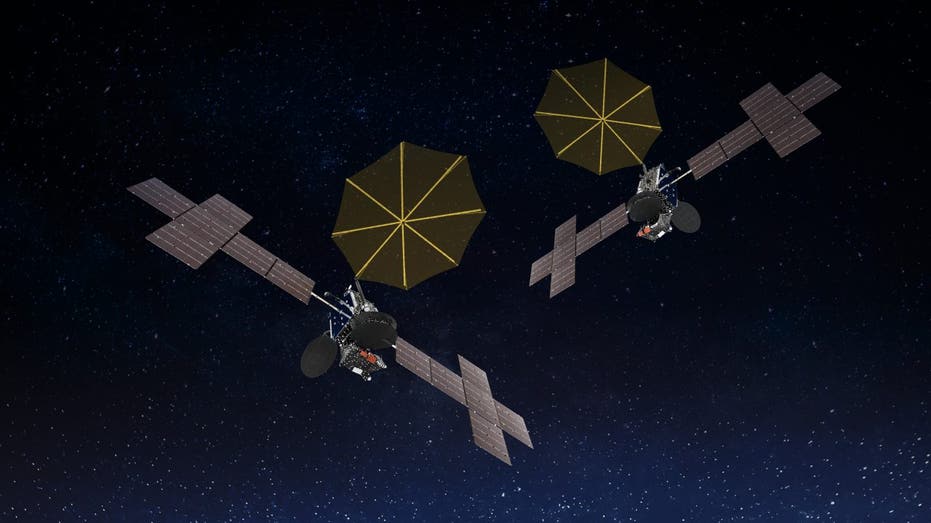

SiriusXM Commissions Maxar to Build Two New Satellites, SXM-11 and SXM-12. The Maxar-built SXM-11 and SXM-12 satellites for SiriusXM as shown in an artist rendering. Credit: Maxar. (AP Newsroom)

Based in Westminster, Colo., Maxar owns and operates a constellation of satellites that allows it to collect detailed images from space. Its technology is used for geospatial intelligence and defense and also powers Google Maps. Images in the news of the battlefield in Ukraine are often provided by Maxar.

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| GOOG | ALPHABET INC. | 323.10 | -8.23 | -2.48% |

NASA'S ARTEMIS I ROCKET LAUNCHES ON HISTORIC JOURNEY TO THE MOON

The company, whose origins date back to 1957, has 90 satellites in orbit, counts 70 countries among its customers and employs 4,400 people, according to its website. It trades on both the New York Stock Exchange and the Toronto Stock Exchange.

Maxar Technologies Inc.

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| MAXR | NO DATA AVAILABLE | - | - | - |

Boston-based Advent has completed over 400 private-equity investments across 41 countries. Founded in 1984, the firm had $89 billion in assets under management as of Sept. 30. It finished raising a $25 billion fund earlier this year.

Advent has invested $28 billion in defense, security and cybersecurity over the last three years. Among its portfolio companies are Cobham Advanced Electronics Solutions and Ultra Electronics Group, both of which work closely with the U.S. Defense Department.

Maxar-built Galaxy 35 and Galaxy 36 Satellites for Intelsat Begin Commissioning Activities On Orbit After Launch Maxar-built Galaxy 35 and Galaxy 36 for Intelsat stacked before launch. Credit: Arianespace. (AP Newsroom)

Those relationships helped Advent identify satellite-based intelligence as another priority for the U.S. government, according to Shonnel Malani, a managing director at the firm who oversees investments in the defense sector.

SMASHING SUCCESS: NASA ASTEROID STRIKE RESULTS IN BIG NUDGE

"For us, this is a growth story," Mr. Malani said of Maxar. "This is a business that has been relatively underappreciated by the public markets."

He said Advent plans to help accelerate the company’s planned launch of a new constellation of satellites.

CLICK HERE TO GET THE FOX BUSINESS APP

Advent’s deal with Maxar is subject to a 60-day "go-shop" period during which the company can seek out competing offers.