Ford's profits getting eaten up by EVs

Ford lost about $4.7 billion on EVs last year and projects losses in the range of $5 billion to $5.5 billion this year

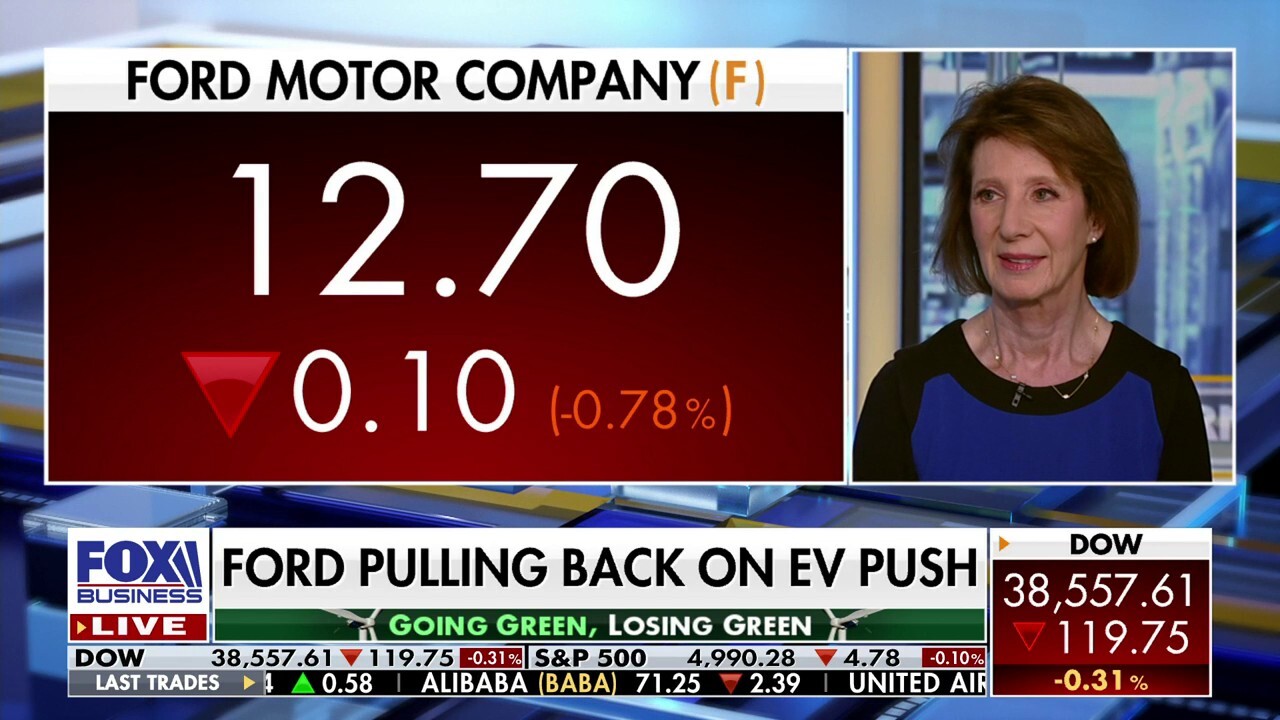

Consumers ‘don’t want to buy’ EVs: Diana Furchtgott-Roth

Heritage Foundation economist Diana Furchtgott-Roth discusses the electric vehicle markets as more automakers pull back on EV production.

The electric vehicle (EV) push is eating into Ford’s profit margins as the company seeks to find the right mix between profitable vehicles consumers want today and the next generation of EVs that may be in higher demand as the market’s preferences shift in the future.

Ford Model e, the company’s EV division, had a net loss of $4.7 billion last year — with $1.6 billion of that in the last quarter — and Ford's chief financial officer John Lawler explained during the company’s earnings call on Tuesday that both "the quarter and year were impacted by challenging market dynamics and investments in next-generation vehicles."

Lawler added that Ford expects Model e "losses to widen to a range of $5 billion to $5.5 billion, driven by continued pricing pressure and investments in our next-generation vehicles" while noting that the company expects "our first-generation vehicles to improve their profits throughout the year."

The Wall Street Journal noted that if Ford weren’t selling Mustang Mach-E and F-150 Lightning vehicles while also investing in the next generation of EVs that will eventually supplant those, the automaker’s adjusted operating profit would be about 50% higher than it currently is.

FORD HYBRID SALES JUMP IN JANUARY AS EVS SLIDE

Ford lost about $4.7 billion on EVs last year and projects a loss of about $5 billion to $5.5 billion this year in that segment. (Scott Olson/Getty Images / Getty Images)

Ford's CEO Jim Farley said Tuesday during the company’s earnings call that the EV market is going through a "seismic change" over the last six months of last year that will "rapidly sort our winners and losers in our industry."

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| F | FORD MOTOR CO. | 13.80 | +0.08 | +0.58% |

He said the catalyst for the change is a shift in EV makers cutting prices by 20% across major markets as well as an influx of investment and capacity in the two-row crossover segment.

Farley said that Ford’s targets for its next generation of EVs will be for them to be profitable within 12 months of their launch and that it will spend less on making larger EVs by focusing those models on "geographies and product segments where we have a dominant advantage, like trucks and vans."

FORD UNVEILS REDESIGNED 2025 EXPLORER FEATURING NEW DIGITAL EXPERIENCE

Ford is planning to focus its next-gen EV efforts on models that will be profitable within 12 months of launch. (JEFF KOWALSKY/AFP via Getty Images / Getty Images)

"Those products will have breakthrough efficiency compared to our Gen 1 products, and they’re going to be packed with innovations that customers are going to be excited to pay for," he said, adding that Ford will focus more on the development of smaller EVs.

Farley explained that two years ago, Ford "made a bet in silence" and brought on a "super-talented skunkworks team to create a low-cost EV platform" that has developed a flexible platform to help deploy multiple types of vehicles that include installed software and services.

GET FOX BUSINESS ON THE GO BY CLICKING HERE

"All of our EV teams are ruthlessly focused on cost and efficiency in our EV products, because the ultimate competition is going to be the affordable Tesla and the Chinese OEMs (original equipment manufacturers)," he said. "And that bet and all of the rightsizing of capital and even delays to some of our products, given the market realities, better balance growth, profits and returns for us."