Goldman Sachs shares sink after brutal quarter

Goldman's profits fell 66% compared to 2021 while costs ticked higher

Holding debt limit hostage won’t fix spending problems: Douglas Holtz-Eakin

Former Congressional Budget Office director Douglas Holtz-Eakin dissects the battle raging over the debt limit which the U.S. is expected to reach on Thursday.

Shares of Goldman Sachs sank on Tuesday after the firm reported a dip in net revenues and bigger-than-expected 69% drop in fourth-quarter profits.

The stock is on pace for the worst session since January 2022 when it dropped 6.97% as tracked by Dow Jones Market Data Group.

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| GS | THE GOLDMAN SACHS GROUP INC. | 928.44 | +38.49 | +4.32% |

Quarterly profit was 39% below the consensus estimate, nosediving 66% from 2021 to $1.33 billion, or $3.32 per share.

David Solomon, Chairman and Chief Executive Officer, said "Against a challenging economic backdrop, we delivered double-digit returns for our shareholders in 2022."

David Solomon, chief executive officer of Goldman Sachs Group Inc. (Photographer: Michael Nagle/Bloomberg via Getty Images / Getty Images)

"Our clear, near term focus is realizing the benefits of our strategic realignment which will strengthen our core businesses, scale our growth platforms and improve efficiency," he added. "The foundation of all of our strategic efforts is our client franchise which is second to none."

This month Goldman cut over 3,000 workers.

Goldman Sachs

FUND MANAGERS MOST UNDERWEIGHT ON US STOCKS SINCE 2005: BANK OF AMERICA SURVEY

Meanwhile, net revenues reached $10.59 billion for the fourth quarter of 2022, but were 16% lower than the same period in 2021 and 12% lower than the third quarter of 2022.

The drop reflected significantly lower net revenues in asset and wealth management and lower net revenues in global banking and markets, the company disclosed.

INFLATION IS 'DEADER' THAN A DOORNAIL: KEN FISHER

As profit and revenue slipped, operating expenses reached $8.09 billion, 11% higher than the same period in 2021 and 5% higher than the third quarter of 2022.

Bank earnings season is underway

Last week, JPMorgan Chase, Citigroup, Wells Fargo, and Bank of America all reported fourth quarter earnings, beating analysts’ expectations across the board.

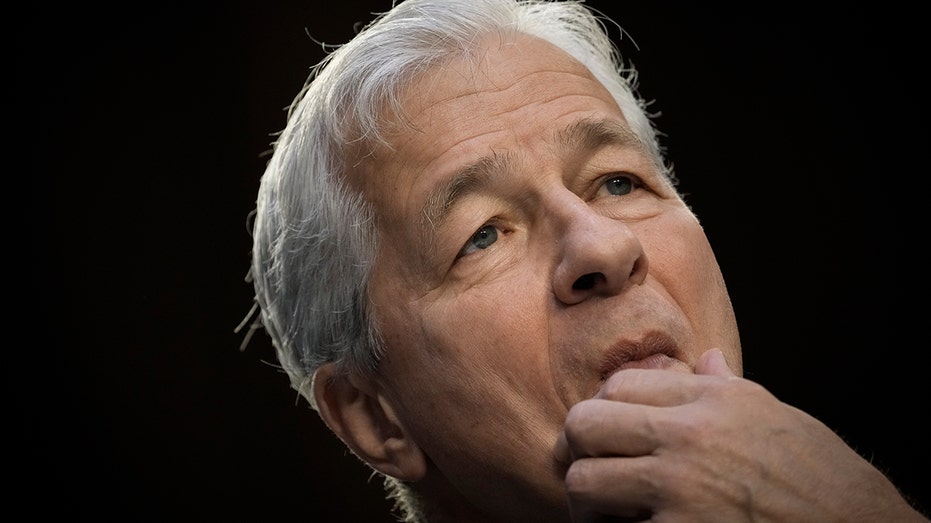

Despite positive earnings, JPMorgan Chase & Co CEO Jamie Dimon, foresees more political and economic ‘headwinds’ down the road. (Drew Angerer/Getty Images / Getty Images)

The upbeat results came despite an industry-wide dip in deal activity like home mortgage loans and initial public offerings.

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| JPM | JPMORGAN CHASE & CO. | 322.35 | +12.31 | +3.97% |

| C | CITIGROUP INC. | 122.66 | +6.94 | +6.00% |

| WFC | WELLS FARGO & CO. | 93.93 | +1.95 | +2.12% |

| BAC | BANK OF AMERICA CORP. | 56.55 | +1.64 | +2.99% |