NYSE technical trading glitch hits Berkshire Hathaway, others

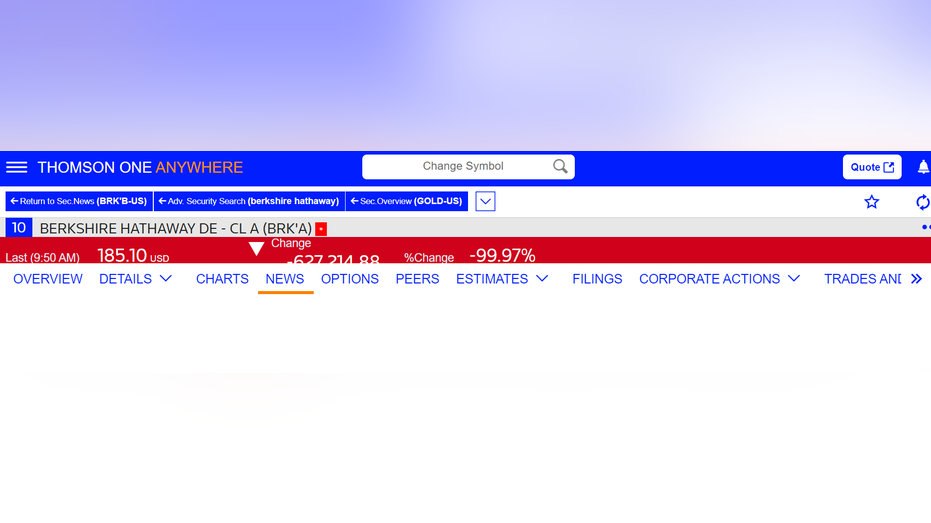

Berkshire Hathaway were show to be down nearly 100% as trading glitch snarls NYSE

Ray Wang: Only a handful of stocks will win with AI

Constellation Research Founder R. 'Ray' Wang weighs in on which stocks will perform best with Artificial Intelligence on 'Varney & Co.'

The New York Stock Exchange experienced a technical glitch impacting a handful of stocks, including Barrick Gold and Warren Buffett's Berkshire Hathaway, which was shown to be down nearly 100% before the issue was fixed shortly before noon Eastern time.

Berkshire Hathaway Class A Shares (ThomsonOne )

"After the market opened on the morning of June 3, 2024, a technical issue involving industry-wide price bands published by the Consolidated Tape Association’s Securities Information Processor triggered "limit-up/limit down" trading halts on up to 40 symbols listed on NYSE Group exchanges. Shortly before noon, the issue was resolved and trading in the impacted stocks resumed. A list of the affected symbols is posted below. The NYSE is reviewing potentially impacted trades" the exchange said in an updated statement.

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| BRK.A | BERKSHIRE HATHAWAY INC. | 762,569.63 | +5,626.63 | +0.74% |

| GOLD | GOLD COM INC | 55.30 | +4.95 | +9.83% |

Multiple trading halts, which can occur when there is excess buying or selling or if there is news anticipated, were listed on the exchange's site.

GAMESTOP SHARES SURGE GAIN ON NEW ROARING KITTY POST

Berkshire's A class stock was impacted. Trading in the B-class shares appeared normal.

Berkshire Hathaway

Shares of the NYSE's parent company, Intercontinential Exchange, were marginally lower. There were no trading issues reported by rival Nasdaq.

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| ICE | INTERCONTINENTAL EXCHANGE INC. | 168.98 | +0.64 | +0.38% |

| NDAQ | NASDAQ INC. | 84.83 | -0.68 | -0.80% |

The Dow Jones Industrial Average, S&P 500 and Nasdaq Composite were little changed.

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| I:DJI | DOW JONES AVERAGES | 50115.67 | +1,206.95 | +2.47% |

| SP500 | S&P 500 | 6932.3 | +133.90 | +1.97% |

| I:COMP | NASDAQ COMPOSITE INDEX | 23031.213218 | +490.63 | +2.18% |

GET FOX BUSINESS ON THE GO BY CLICKING HERE

FOX Business' Christopher Mulligan contributed to this report