‘Roaring Kitty’s GameStop position is in the money

52-week high for GameStop shares was $64.83

Breaking down the intense interest in 'Roaring Kitty' livestream

'Barron's Roundtable' panelists offer their market outlook and discuss three things investors should be thinking about.

GameStop shares fell for the second straight session Monday, down over 49%, notching the worst two-day stretch since February 3, 2001, as tracked by Dow Jones Market Data Group.

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| GME | GAMESTOP CORP. | 24.99 | +0.33 | +1.34% |

Still, "Roaring Kitty," also known as Keith Gill, is in the money with his GameStop holdings.

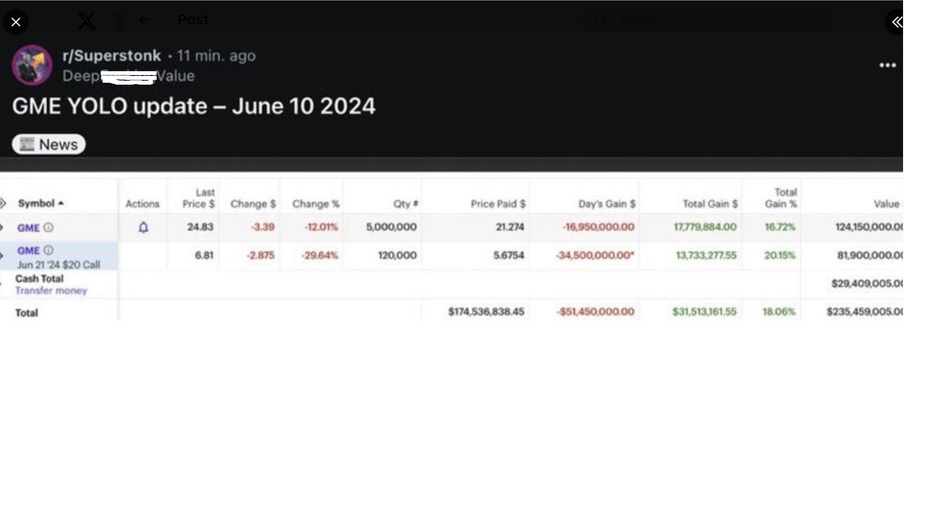

Gill, via his Reddit handle, Superstonk/Deep F-ing Value, posted his latest account performance on Monday. FOX Business, in coordination with Dow Jones Market Data Group, crunched the numbers.

WHAT TO KNOW ABOUT 'ROARING KITTY'

Gill, via his Reddit handle, Superstonk/Deep F-ing Value, posted his latest account performance on Monday. (Superstonk / Reddit )

Five million shares are worth $124.15 million as of today's close, up $17.78 million from the $106.37 he purchased them for.

As for his $20 call options that he purchased for $5.67, each are currently trading at $6.81. The value of those options contracts are $81.72 million, up $13.62 million from the $68.10 million he purchased them for.

'ROARING KITTY' BETS BIG ON GAMESTOP MANAGEMENT TEAM

With the call options, if he exercises them, Gill will have the ability to purchase 12 million shares at $20 a share, 120,000 contracts with each contract worth 100 shares, as detailed by Dow Jones Market Data Group. FOX Business is unable to independently confirm the accuracy of Gill's posts.

Gill’s update follows his YouTube live stream on Friday, his first return to the social media broadcaster in about three years.

Keith Gill, a Reddit user credited with inspiring GameStop's rally, is shown during a YouTube livestream on a laptop at the New York Stock Exchange on June 7, 2024. (Michael Nagle / Bloomberg / Getty Images)

The livestream, watched by around 600,000, had Gill reiterating his belief in the video game retailer with little new detail.

"It becomes a bet on the management" of GameStop — particularly on CEO Ryan Cohen "and his crew" — during the "transformation stage" that he believes the video game retailer has entered. "That’s probably going to be an ongoing debate as to how people feel about him, whether he can successfully transform that business," the meme stock retail trader said, cracking jokes here and there. He also reminded his viewers to "make your own decisions."

GameStop Chair Ryan Cohen (FBN)

Cohen founded Chewey.com and attempted a failed turnaround of Bed Bath & Beyond, which filed for bankruptcy and is now part of Overstock.com.

On Friday, ahead of the livestream, GameStop reported a net loss of $32.2 million compared to a loss of $50.5 million in the year-ago period. Sales fell 28% to $881 million, down from $1.2 billion. The company also plans to sell up to another 75,000,000 shares on top of the 45,000,000 already sold.

GameStop

GameStop shares have gained 98% this quarter, largely driven by Gill’s return.