When should you refinance your mortgage?

Refinancing a mortgage can significantly curb your total loan cost — if you do the job right

Mortgage refinancing is a proven way to cut total home loan costs. Learn the ins and outs of the process, including when to refinance your mortgage. (iStock)

Historically, homeowners are more tempted to refinance when interest rates are low — and that’s understandable. After all, if you can refinance into a home loan with a lower interest rate, your monthly mortgage payments will decline, putting more cash in your pocket.

While timing is a huge factor in a mortgage refinancing deal, it isn’t everything. You should consider a number of other factors, and some might be unique to your situation. Whether or not you should refinance is ultimately something only you can decide.

With that said, if you’re currently mulling over a mortgage refinance, here’s when it might make sense to go through with it — and when it might not.

Credible makes it easy to research your mortgage refinance options and compare rates from multiple lenders.

- Should you refinance now?

- Costs associated with refinancing your mortgage

- What are some reasons to refinance?

- How long does it take to refinance?

- How to refinance your mortgage

Should you refinance now?

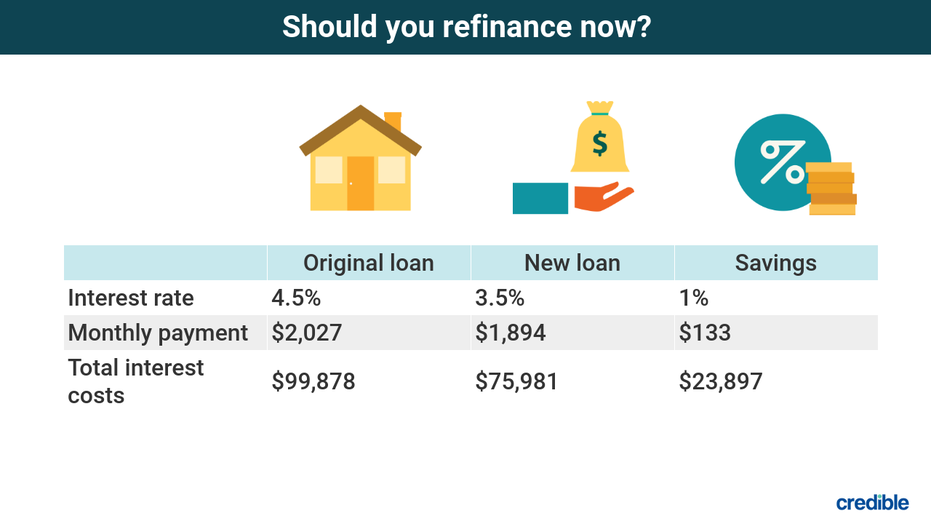

By and large, a mortgage refinance loan is worth doing if it saves you money. That usually means lowering your interest rate by at least 1%.

Here’s an example of how that might look with a $400,000 mortgage balance at 4.5%. Assume you have 15 years remaining on the term, and you’re refinancing into a new 15-year loan at 3.5%.

(Credible)

You’ll see that even a single percentage point reduction in your interest rate can result in significant savings over the life of the loan.

HOW OFTEN CAN YOU REFINANCE YOUR HOME?

Costs associated with refinancing your mortgage

Don’t rush into a mortgage refinance loan without factoring in closing costs. Mortgage loans vary depending on the lender’s requirements and your credit health, loan amount, mortgage term, and loan type, and closing costs vary widely as well. They typically run between 2% and 5% of the loan amount.

Expect to pay these closing costs when taking out a mortgage refinance loan:

- Application fee

- Origination fee

- Credit report fee

- Home appraisal

- Home inspection

- Title fee

In some instances, you can take out a "no-closing-cost" refinance, which rolls the closing costs into the loan. You’ll pay them off over time as part of your new mortgage payment.

Past that, make sure you’re going to live in the home long enough to break even on your closing costs. If you plan to move in a few years, refinancing might not be worth it, since your interest savings won’t amount to more than what you paid in closing fees. Look over the closing costs listed on your Loan Estimate to determine if refinancing makes sense.

With Credible, you can easily check mortgage refinance rates from multiple lenders without affecting your credit.

What are some reasons to refinance?

Consider these four good reasons to refinance a mortgage.

Lower your interest rate

In periods of lower interest rates, you can lower your monthly mortgage payment with a rate and term refinance loan. This lets you lock in a new mortgage with a lower interest rate and different repayment term.

Cutting your interest rate by a percentage point or two may end up saving you thousands of dollars in interest over the life of the loan.

Consolidate household debt

If you’re looking to consolidate high-interest personal debt, a cash-out refinance loan can help you do so. With this loan, you can leverage your home’s equity to pay off credit cards, student loans, and auto loan debt.

Get rid of mortgage insurance

If your home has gone up in value — and you now have 20% equity — you can refinance into a new conventional loan and eliminate private mortgage insurance. This can lead to big savings over time.

Similarly, if you have an FHA loan, you can refinance into a conventional loan to remove your FHA mortgage insurance premiums and lower your monthly costs.

Change loan types

Say you took out an adjustable-rate mortgage (ARM) for the lower introductory fixed rate, but now that initial period is coming to an end. Instead of seeing your rate adjust periodically and potentially facing a higher rate each time, you could refinance into a fixed-rate mortgage.

This move could save you thousands of dollars in interest, especially if mortgage rates are trending up.

REFINANCING REQUIREMENTS FOR A MORTGAGE: WHAT TO KNOW

How long does it take to refinance?

Again, every mortgage refinance loan is unique and delays do take place, especially if your paperwork isn’t updated and correct.

In most cases, however, you can expect a loan refinancing timeline of 30 to 45 days.

Besides paperwork issues, home appraisals and inspections can delay the mortgage refinancing process. Services rendered by third parties — like title search companies or financial institutions who provide consumer data or paperwork to loan issuers — may also cause delays.

You can help ensure the loan process runs smoothly by making sure your paperwork is complete and accounted for.

Consider locking in your interest rate for 30 to 60 days. That way, even if you have paperwork or appraisal delays, your interest rate will stay the same throughout the loan process.

WHEN IS THE RIGHT TIME TO REFINANCE MY MORTGAGE?

How to refinance your mortgage

Take these five steps to secure your mortgage refinance loan:

- Know where you stand. Before looking for a good refinancing loan deal, make sure you know three key things: your mortgage loan balance, the approximate value of your home, and your home equity. Bring those figures to the table when calculating refinancing costs and potential savings.

- Shop for rates. Since even moderate differences in a mortgage rate can amount to big savings, review interest rate options from multiple mortgage refinance lenders.

- Check for closing fees. Once you narrow your selection down to a few lenders, keep researching and see what fees each company charges for its mortgage refinance loan offering. If it’s a lengthy list of fees that go beyond what others are charging, keep looking for a better loan deal elsewhere.

- Get your paperwork in order. A clean paperwork process can mean the difference between delays on your application and a quick approval. Some of the documents you’ll want to have on hand include your most recent mortgage statement, last two pay stubs, last two years’ worth of W-2s or 1099 statements, last two years of tax returns, bank and investment account statements, and proof of homeowners insurance.

- Apply for the refinance loan. Once you’ve decided on a lender and have your paperwork in order, fill out the loan application (most lenders offer digital applications these days). Check the application for accuracy and proofread it to ensure there are no grammatical or document errors.

If you have any questions, contact your loan provider right away. There’s too much at stake to risk losing a refinancing loan due to documentation issues, clerical errors, or misunderstandings.

After you apply for a refinance

Once you apply for the loan, you’ll typically hear back from the lender in three business days or less. The lender will send you a Loan Estimate, which details the proposed loan interest rate, payment amount, and estimated closing costs for the refinancing loan.

Within a week or so, the lender will arrange to have your home appraised, and after that, will review your finances and complete the rest of the underwriting process. Once completed, the lender will either approve your loan, ask for more information, or deny you the loan.

If you’re approved, your mortgage lender will provide a loan amount based on your financial credentials, which may be the same loan amount you requested, along with a loan settlement date.

The lender will send you a Closing Disclosure at least three business days prior to the loan closing date. It includes the same key information found in your Loan Estimate, only now with the actual costs of your loan. Once you review and sign the form, you’ll wait for the loan closing date, when you’ll sign off on the loan and receive your funds either in the form of a check or via direct deposit into your bank account.

To explore your mortgage refinance options, visit Credible to compare rates and lenders.