What are student loan refinance rates?

Monitoring student loan refinance rates and knowing how rates are determined can help you save money when you decide to refinance your student loans

Student loan refinance rates are important to monitor so you can know if you’ll save money on interest and lower your monthly payment. (Shutterstock)

Multiple Federal Reserve interest rate hikes this year have pushed student loan refinance rates higher.

While private student loan refinancing providers generally set their own rates, they’re based on market trends that increase and decrease at different times. If you’re looking to refinance your student loans, interest rates are one of the most important factors to consider.

By visiting Credible, you can learn more about student loan refinancing and compare rates from multiple private student loan lenders.

- Student loan refinance rates at a glance

- How student loan refinancing rates are determined

- Is now a good time to refinance?

- How to refinance student loans

Student loan refinance rates at a glance

Student loan refinance rates can be fixed or variable and are always subject to change. Rates for five- and 10-year fixed-rate student refinance loans have started trending upward. Typically, the longer your repayment term, the higher rate you can expect.

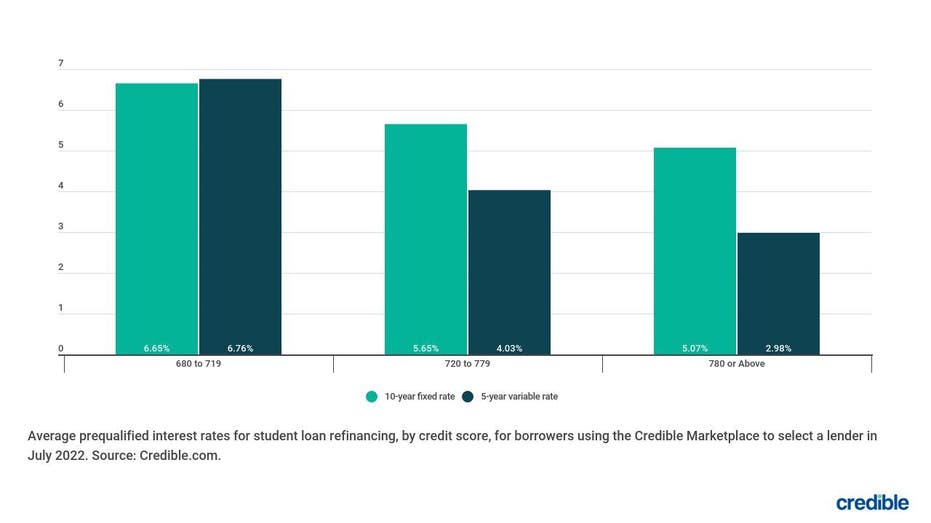

Credit scores also play a key role in determining who can refinance student loans at the most competitive rate. As part of a COVID-19 relief initiative, the CARES Act pauses payments for federal student loan borrowers and sets the interest rate to zero through Aug. 31, 2022.

But the CARES Act relief doesn’t apply to private student loans. Refinancing your private loans for a lower interest rate could help you save money and even manage your payments better. Since private student loans can accrue interest while you’re in school or even during your grace period, it’s important to monitor how much you’re spending on loan repayment over time.

Here’s a look at current student loan refinance rates by credit score for five- and 10-year loan terms:

How student loan refinancing rates are determined

A variety of factors, including federal interest rate changes, affect private student loan rates.

The following factors help determine what interest rate you’ll receive on a student loan refinance:

- Market conditions — Student loan refinance rates were usually based on the prime or LIBOR (London Interbank Offered Rate), a money market interest rate and benchmark for setting interest rates on loans. However, LIBOR will be phased out by June 2023 to make way for a new interest rate index.

- Credit score — Your credit score is another factor lenders use to determine student loan refinancing rates. The lowest market rates are reserved for borrowers with a great credit score. If your credit score is fair or poor, you can expect to pay a higher rate.

- Type of interest rate — Whether the loan has a variable or fixed rate will also affect your rate. With variable-rate student loans, the interest rate adjusts periodically and you could start with a lower interest rate. However, your rate and monthly payment could rise if rates go up. Meanwhile, with a fixed-rate student loan refinance, your interest rate will remain the same throughout your repayment term.

- Employment, education, and income — Your income, field of study, or whether you’ve graduated from college can also affect your rate, but it ultimately comes down to the factors that your lender finds important.

Private student loan lenders want to see that you have a good credit score and enough income to make consistent loan payments in addition to your other regular expenses and debt payments.

You can easily compare prequalified rates from multiple lenders using Credible.

Is now a good time to refinance?

Refinancing your student loans is a very personal decision since it depends on your unique situation. Refinancing student loans isn’t always the best option for everyone, so ask some of these questions to determine if now is a good time to refinance:

- How much debt do you have? Refinancing can be a debt relief option if you have high-interest student loans. Also, if you’re managing other debt payments, lowering your student loan interest rate could help stretch your dollar. However, lenders may also look at your debt-to-income ratio when reviewing a refinance application, so you may want to wait until your finances and cash flow have improved if you’re overwhelmed with debt.

- What type of student loans do you have? Private student loans are often worth refinancing if you can get better terms than your original loan. But consider with federal student loans, you’ll lose access to federal relief programs like deferment, forbearance, income-driven repayment plans, and student loan forgiveness if you switch to a private lender by refinancing.

- Will refinancing actually save you money? It’s important to run the numbers to see if student loan refinancing will actually help you save money in the long run. You can shop around for offers and compare interest rates. Use a student loan calculator to determine what your new monthly payment could be, as well as the total cost of your loan.

How to refinance student loans

If you’re thinking about refinancing your student loans, the process is simple and can be completed in five steps:

- Check your credit. Since lenders will check your credit when you apply, it’s a good idea to review your credit report and check your score beforehand. That way, you can correct any errors or inaccurate information. Also, if your credit score is lower than expected, decide if you want to try to improve it before refinancing your student loans. This could involve paying down other debts, settling any collections accounts, and making all your bill payments on time.

- Shop for loan rates. Shop around and compare loan rates from multiple lenders to ensure you’re getting the best terms. With Credible, you can fill out a short form and get offers from multiple lenders to compare side-by-side. This won’t affect your credit score, but it can help you get prequalified and narrow down your options.

- Choose a loan. Decide which student loan refinancing offer is best for you. Make sure you feel comfortable with the repayment term, interest rate, and fees.

- Submit an application. Once you choose a loan, you’ll need to submit an application. This requires providing more details than you did to get prequalified. You’ll need to verify your income and provide other supporting documentation. When your application is submitted, the lender will review it and give you a loan decision.

- Sign loan documents and receive your loan funds. If your student loan refinance application is approved, you’ll need to sign the final loan documents. Then, the lender will either pay off your current loan provider or send you the money to do so.

From there, you’ll start making payments on your newly refinanced student loan with your new lender.

Refinancing student loans may be a solid option if you have good credit, a steady income, and want to take advantage of better rates or a lower payment. Use Credible to compare student loan refinances rates from various lenders, all in one place.