IBM vice chair points out flaw in Biden billionaire claim

Biden proposed a minimum 25% tax on wealthiest Americans during State of the Union

The American taxpayer is 'fed up, and we have to put our foot down': John Catsimatidis

Gristedes CEO John Catsimatidis reacts to President Biden's economic talking points during the State of the Union and his proposals on raising the corporate tax and taxing the rich.

President Biden’s jab at billionaires not paying their fair share during his State of the Union address last week is flawed, according to Gary Cohn, IBM vice chair and former Trump economic adviser, who said that billionaires with income in the U.S. pay at least 20% in taxes.

Cohn appeared on CBS's "Face the Nation" to dispel how Biden tried to tap into the perception that the wealthy have greater advantages than the "little guy" after Biden claimed that billionaires pay a lower tax rate than teachers and proposed slapping a minimum tax of 25% on billionaires.

"If you actually look at who pays taxes in this country, the bottom 50% of earners in the United States pay 2.3% of tax collected, and the top 10% pays over 70% of tax collected in this country," Cohn said, adding that this is in large part thanks to how the Trump administration redid the tax code in 2017.

Cohn then identified a problem with Biden's talking point about billionaires, noting that a billionaire is a measure of net worth, not a description of one's taxable income.

BIDEN, IN STATE OF THE UNION, TO CALL FOR WEALTH TAX AND HIGHER TAXES ON BUSINESSES

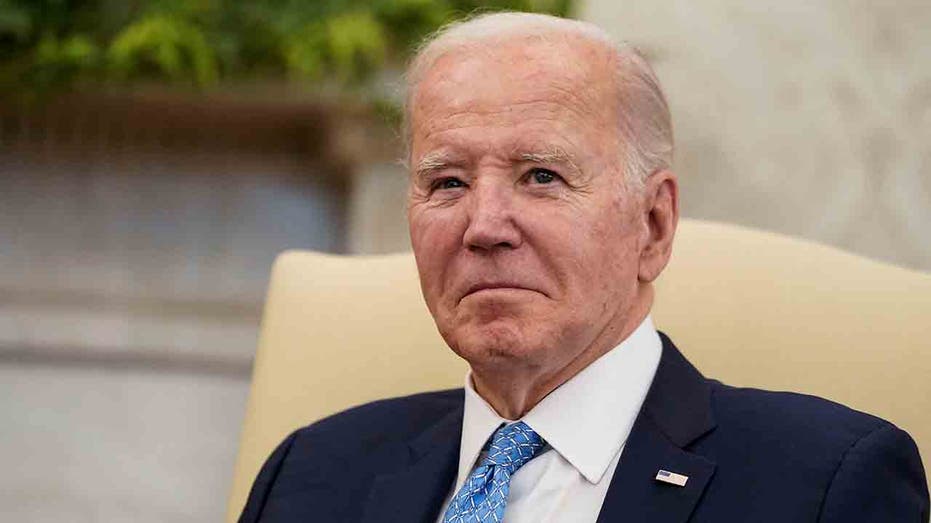

During his State of the Union address, Biden called for a 25% tax on the wealthiest Americans. (Reuters/Elizabeth Frantz/File / Reuters Photos)

"You could be a billionaire and have no taxable income," he said. "You could not have $1 billion and have a high taxable income."

5 KEY HIGHLIGHTS FROM PRESIDENT BIDEN'S SOTU SPEECH

Cohn said this is because some people may be sitting on assets, some of which may be liquid or illiquid.

Cohn was the director of the National Economic Council under President Trump and helped to reform the tax code. (Drew Angerer/Getty Images / Getty Images)

"We do a very good job in this country of taxing income," he said. "There is no income in this country, unless you buy a tax-free bond, that doesn't get taxed at a minimum of 20%, whether it's interest or dividends or capital gains. So, there's no billionaire in this country that has income that is not paying at least 20%."

We have a system where the top 1% pay almost half the taxes: Steve Moore

Freedomworks chief economist Steve Moore discusses how the top 1% pay almost half of all federal income taxes on ‘The Bottom Line.’

GET FOX BUSINESS ON THE GO BY CLICKING HERE

Biden also wants to increase the corporate tax rate from 21% to 28%, and increase the 15% corporate minimum tax on companies reporting over $1 billion in profit that was included in the 2022 Inflation Reduction Act to 21%.

FOX Business' Eric Revell contributed to this report.