Traders bet big on Fed rate cut as December odds soar above 80% on prediction markets

The Fed’s next opportunity to adjust interest rates is at its Dec. 9-10 policy meeting

Federal Reserve faces mounting pressure after series of policy missteps

Macromavens President Stephanie Pomboy joins ‘Mornings with Maria’ to discuss rising layoffs, collapsing small business hiring plans and why flawed payroll data may be giving a false picture of job growth.

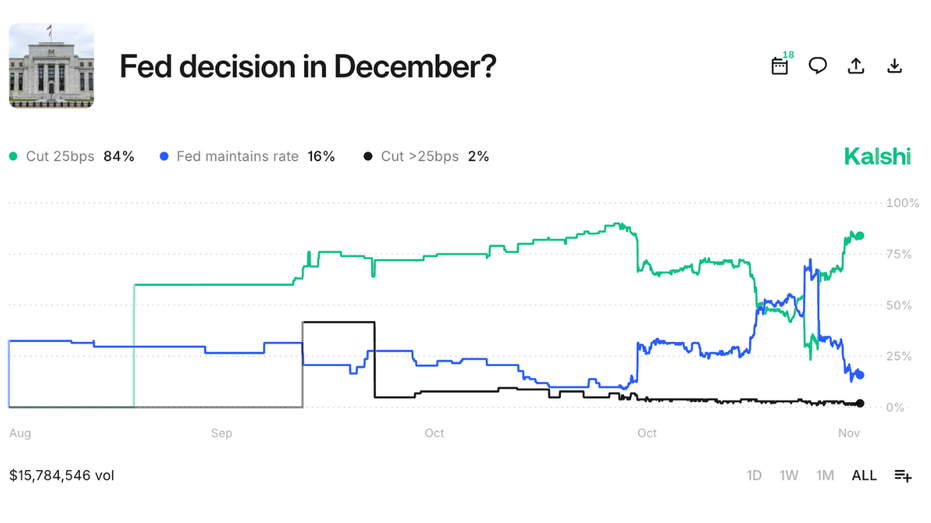

Prediction markets are heavily signaling a 25-basis-point interest rate cut in December, with probabilities hovering above 80% on both Kalshi and Polymarket.

Traders on both platforms see only a slim chance of the Federal Reserve holding rates steady and virtually no expectation of a larger move.

On Polymarket, the trading volume, or the total dollar amount wagered on this market, is a little over $171 million.

AS THE HOLIDAYS APPROACH, THANKSGIVING BECOMES TRUMP'S ECONOMIC TEST

A Polymarket wager tracking the Federal Reserve’s December interest rate decision. (Polymarket)

Meanwhile, on Kalshi, more than $15.8 million worth of bets have been placed on the Fed decision market.

FED'S WALLER SAYS HE FITS THE BILL FOR CENTRAL BANK LEADERSHIP AFTER BESSENT MEETING

Kalshi and Polymarket let users bet real money on everything from politics and economic policy to sports and pop culture, transforming public sentiment into tradable market odds.

A Kalshi wager tracking the Federal Reserve’s December interest rate decision. (Kalshi)

The Federal Reserve’s next scheduled opportunity to adjust interest rates is at its Dec. 9-10 policy meeting, when its rate-setting committee meets to decide whether to raise, cut or hold.

The meeting unfolds amid the Trump administration’s efforts to address the affordability crisis, defined by rising housing costs, elevated prices for necessities and increasing financial strain on families.

VOTERS EXPRESS ECONOMIC WORRIES OVER INFLATION AS COSTS RISE, FOX NEWS POLL FINDS

Jerome Powell, chairman of the Federal Reserve, was tapped by Trump to lead the nation's central bank. (Al Drago/Bloomberg/Getty Images / Getty Images)

President Donald Trump has, in turn, placed blame on Federal Reserve Chairman Jerome Powell for not cutting rates more aggressively. Powell's chairmanship ends in May 2026.

CLICK HERE TO GET FOX BUSINESS ON THE GO

Meanwhile, Treasury Secretary Scott Bessent wrapped interviews for Powell’s potential replacement on Tuesday, and Trump may announce a new Fed chair by Christmas.