Trump and Biden oppose Nippon-US Steel merger: What is VP Kamala Harris' position?

US Steel has said its deal with Nippon Steel will strengthen the domestic steel industry

US Steel shareholders approve Nippon Steel takeover

FOX Business correspondent Lydia Hu has the latest on the deal supporters believe will make the steel industry stronger and more competitive on 'The Bottom Line."

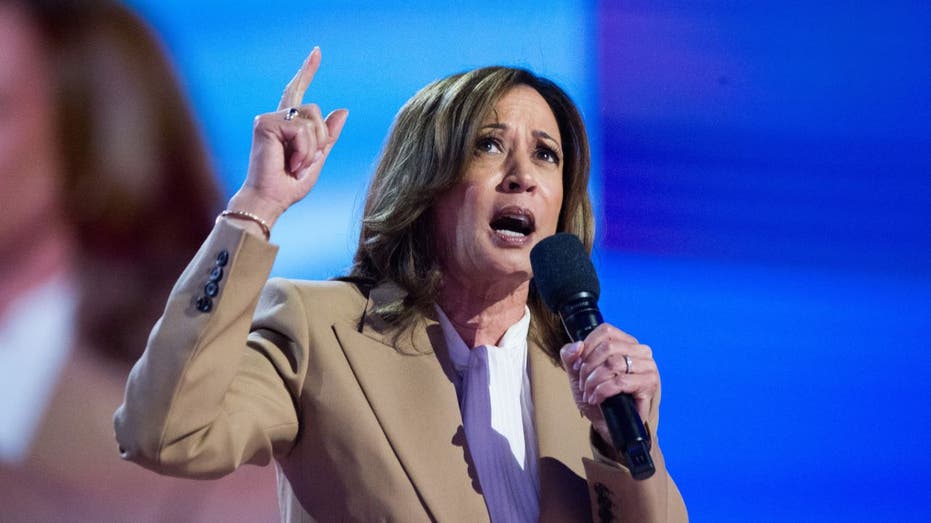

Vice President Harris' views on the pending merger of U.S. Steel and Nippon Steel remain unclear. The Democratic Party's nominee has yet to weigh in on the proposed deal that has attracted bipartisan political scrutiny despite shareholders voting decisively in favor of the deal.

The deal, which would have Nippon Steel acquire U.S. Steel for $14.9 billion, is undergoing a review by the Committee on Foreign Investment in the U.S. and has drawn criticism from some unionized workers and certain politicians in both the Democratic and Republican parties.

While President Biden said in March he opposes the deal, Harris has yet to publicly articulate her position on the merger and whether she would follow Biden in attempting to block it should she win the election.

FOX Business reached out to the Harris campaign regarding her views on the U.S. Steel-Nippon Steel merger and did not receive a response before publication.

POTENTIAL DEM VP PICK SAYS HE CAN'T SUPPORT US STEEL-NIPPON STEEL MERGER

Vice President Kamala Harris hasn't weighed in on the U.S Steel-Nippon Steel merger. (Jacek Boczarski/Anadolu via Getty Images / Getty Images)

Pennsylvania Gov. Josh Shapiro, a Democrat who was one of the leading contenders to become Harris' running mate, said in late July that "if the U.S. steelworkers aren't happy with this deal, which they are not, I'm not happy with this deal."

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| X | NO DATA AVAILABLE | - | - | - |

| NPSCY | NIPPON STEEL CORP. | 4.39 | +0.00 | +0.00% |

Former President Trump, who is now Harris' main rival for the presidency, expressed opposition to the deal in February and reiterated that view Monday.

"I will stop Japan from buying United States Steel," Trump said at an event in Pennsylvania. "They shouldn't be allowed to buy it."

NIPPON STEEL SAYS US STEEL ACQUISITION WOULDN'T CAUSE LAYOFFS, PLANT CLOSURES

U.S. Steel has said its deal with Nippon Steel would strengthen the American steel industry and benefit workers as well as supply chains. (Justin Merriman/Bloomberg via Getty Images / Getty Images)

Nippon Steel, which is based in Japan but is not a state-owned enterprise, has worked with U.S. Steel in an effort to assuage the concerns about the merger raised by politicians and labor groups.

The company previously said it would honor all of U.S. Steel's collective bargaining agreements and has offered new commitments to the union beyond its existing agreement.

It has also said the deal wouldn't prompt layoffs or plant closures and pledged to preserve U.S. Steel's name, brand and headquarters in the deal.

NIPPON STEEL HIRES FORMER TRUMP OFFICIAL MIKE POMPEO TO ADVISE ON US STEEL ACQUISITION

Ninety-eight percent of U.S. Steel shareholders voted decisively in favor of the merger with Nippon Steel. (Justin Merriman/Bloomberg via Getty Images / Getty Images)

U.S. Steel did not immediately respond to a request for comment. The company previously told FOX Business, "We remain committed to the transaction with Nippon Steel, which is the best deal for our employees, shareholders, communities and customers.

"The partnership with Nippon Steel, a long-standing investor in the United States from our close ally Japan, will strengthen the American steel industry, American jobs and American supply chains and enhance the U.S. steel industry's competitiveness and resilience against China," U.S. Steel's previous statement explained.

When U.S. Steel shareholders voted on the deal in April, it was approved with 98% of the vote in favor among the shares voted, which made up about 71% of the company's outstanding stock.

GET FOX BUSINESS ON THE GO BY CLICKING HERE

Nippon Steel recently pushed back the expected closing date for the deal from September to December in response to a Justice Department antitrust probe, though the company said it still expects the merger to proceed.

Reuters contributed to this report.