Mortgage rates climb for fifth week on job growth and inflation

The benchmark 30-year rate rose to 6.73%

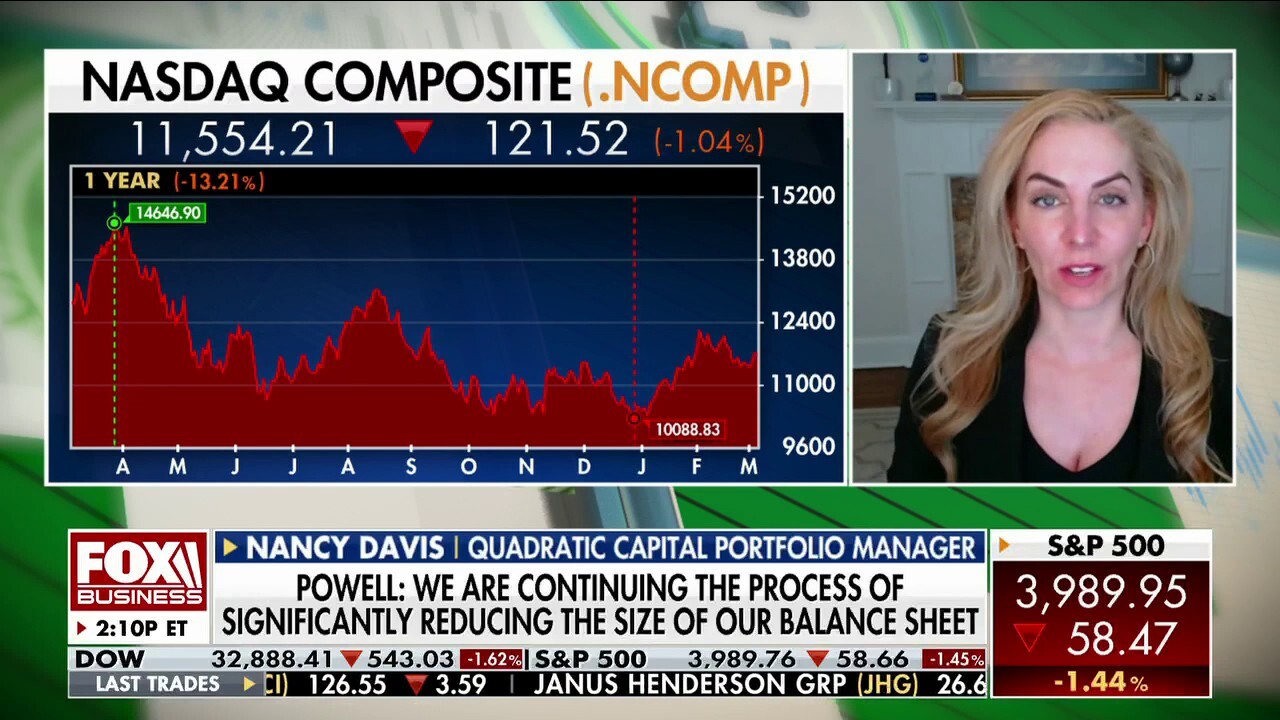

Nancy Davis: Investors should be careful about volatility in mortgages

Quadratic Capital managing partner and CIO Nancy Davis provides insight on the housing market and the Fed's balance sheet on 'Making Money.'

The average rate on a 30-year fixed mortgage rose to 6.73% on Thursday from 6.65% last week, according to mortgage buyer Freddie Mac. A year ago, the average rate was 3.85%.

The 15-year fixed-rate mortgage averaged 5.95%, up from last week when it averaged 5.89%. A year ago at this time, the 15-year FRM averaged 3.09%.

Despite fluctuations, mortgage rates have been trending upward. Since peaking at 7.08% in November, mortgage rates remain nearly double what they were a year ago.

"Mortgage rates continue their upward trajectory as the Federal Reserve signals a more aggressive stance on monetary policy," said Sam Khater, Freddie Mac’s Chief Economist.

A "For Sale" sign is posted outside a home converted into condominium units, Feb. 7, 2023, in Exeter, N.H. (AP Photo/Charles Krupa / AP Images)

JOBLESS CLAIMS RISE SHARPLY TO HIGHEST LEVEL SINCE DECEMBER

The Federal Reserve's interest rate hikes have increased the cost of borrowing. On stubborn inflation and recent job growth data the Fed has signaled it's intent to become more hawkish, likely driving of the cost of borrowing even higher.

Inflation has been a loose-loose situation for the Federal Reserve as the central bank attempts to control rising prices with higher interest rates, potentially triggering a recession or economic slowdown.

Federal Reserve Chairman Jerome Powell speaks during a House Financial Services Committee hearing to examine the Semiannual Monetary Policy Report to Congress, Wednesday, Mar. 8, 2023, on Capitol Hill in Washington. During hist testimony he signaled (AP Photo/Jose Luis Magana)

CLICK HERE TO GET THE FOX BUSINESS APP

Khater continued: "Overall, consumers are spending in sectors that are not interest rate sensitive, such as travel and dining out. However, rate-sensitive sectors, such as housing, continue to be adversely affected. As a result, would-be homebuyers continue to face the compounding challenges of affordability and low inventory."

The central bank's rate-setting committee meets on March 21 and 22.

HOUSING AFFORDABILITY AT RECORD LOW, REPORT SAYS

Atlanta Fed warns US housing affordability is worse than 2007-08

FOX Business' Gerri Willis speaks to new-homeowner-hopefuls Sam and Jacky Pascal, who have felt a 'dramatic' emotional impact from the real estate market.