GM, Ford announce several car models will lose electric vehicle tax credit in 2024

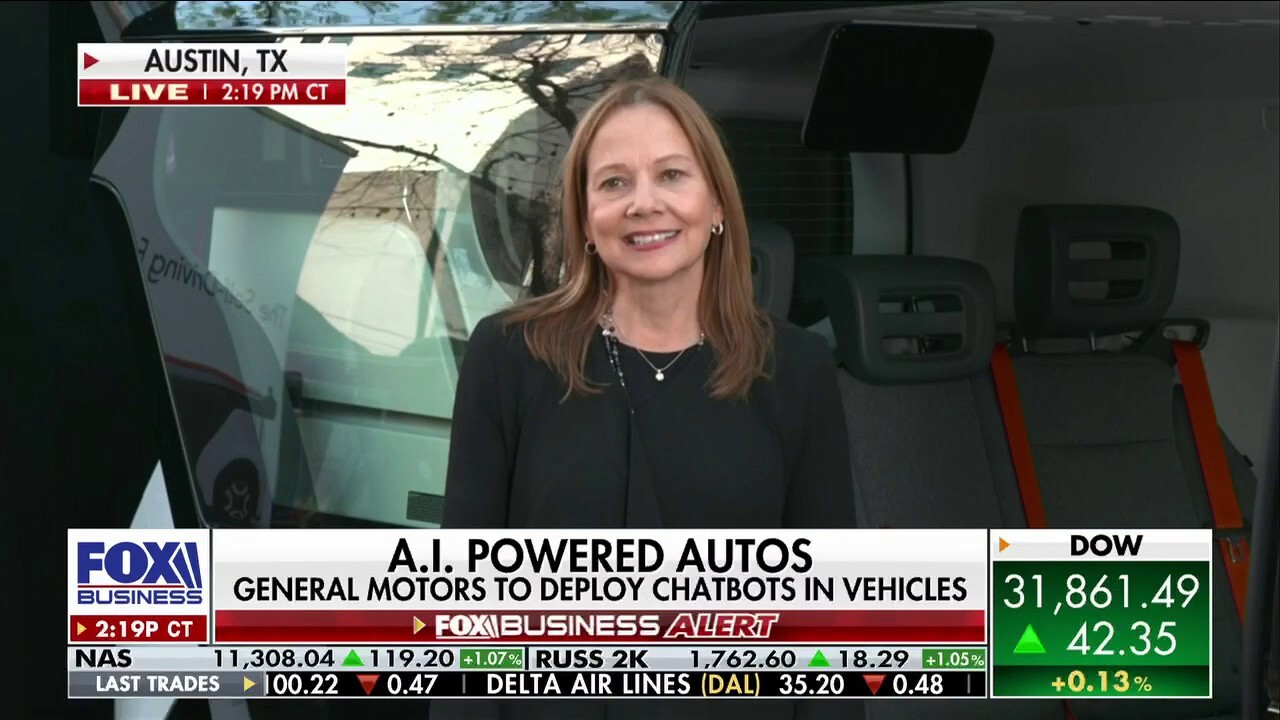

GM ‘in it to win it’ with new autonomous vehicle, AI tech: CEO Mary Barra

General Motors CEO Mary Barra discusses several topics surrounding the automaker, including plans to integrate artificial intelligence into vehicles and a new autonomous vehicle.

General Motors and Ford Motor Company announced some of their vehicles will become ineligible for the electric vehicle tax credits in the U.S. beginning on Jan. 1.

General Motors said Thursday that the Cadillac Lyriq and Chevrolet Blazer will temporarily be impacted. Ford said its E-Transit won't be eligible for the $3,750 tax credit beginning on Jan. 1, as well as the Mach-E and Lincoln Aviator Grand Touring plug-in hybrid.

Ford's F-150 EV Lighting will still be eligible for the $7,500 tax credit, adding that the Lincoln Corsair Grand Touring will also keep its $3,750 tax credit. The Chevrolet Bolt EV will also remain eligible for the tax credit on Jan. 1.

Reuters reported that the temporary tax credit loss is due to two components of the car described as minor, stating that GM expects eligibility to come back for the Lyriq and Blazer in early 2024.

POPULAR BRAND SOLD AT WALMART, TARGET, AMAZON RECALLS MORE THAN 300K AIR FRYERS OVER BURN HAZARD

Defined by taut lines and clean surfaces, Lyriq is assertive and modern, characterized by a low, fast roofline and wide stance that emphasize agility and convey confidence. (Cadillac / Fox News)

The development comes after guidance released by the Biden administration on Dec. 1 limited Chinese components in batteries.

GM said it has developed sourcing plans for qualifying components.

The all-electric and Motor Trend SUV of the Year Chevrolet Blazer EV is on display during the 2023 Los Angeles Auto Show at the Los Angeles Convention Center in Los Angeles on Nov. 24. (Josh Lefkowitz/Getty Images / Getty Images)

MORE THAN 3,000 AUTO DEALERS SIGN LETTER OPPOSING BIDEN’S ELECTRIC VEHICLE MANDATE

"Treasury proposed strict rules disqualifying all EVs with certain foreign battery content including low-value components, which effectively means most EVs will not be eligible beginning on January 1," GM said in a statement.

The GM logo is seen on the facade of the General Motors headquarters in Detroit. (REUTERS/Rebecca Cook/File Photo / Reuters Photos)

The Chevrolet Equinox EV, Chevrolet Silverado EV, GMC Sierra EV and Cadillac OPTIQ produced "after the sourcing change will be eligible for the full incentive," GM said.

F-150® Lightning® is going global for the first time with entry into Norway, the world’s most advanced electric vehicle market. (Ford / Fox News)

GET FOX BUSINESS ON THE GO BY CLICKING HERE

Tesla's Model 3 Rear-Wheel Drive and Long Range vehicles will lose eligibility for the tax credits on Jan. 1, the company said last week.

Reuters contributed to this report.