S&P 500 hits 5,000 for first time; Microsoft topples Apple as world's largest company

Microsoft on pace to be the first U.S. company to close with a market cap above $3.1 trillion

Stock market rally does not hang on the fate of 'Magnificent Seven': Brian Belski

BMO Capital Markets Chief Investment Strategist Brian Belski argues the stock market rally is broader than investors think on 'Making Money.'

The S&P 500 has never been higher, closing above the 5,000 level for the first time ever as improving corporate earnings and better-than-expected economic data fuel investor optimism.

That optimism got an extra push Friday after revised data showed consumer inflation moderated at the end of last year, according to the Bureau of Labor Statistics.

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| SP500 | S&P 500 | 6932.3 | +133.90 | +1.97% |

However, strategists caution the upward move is heavily tied to just a handful of companies.

"Technology is really important, as you know. Look at Microsoft, Apple, Nvidia make up 18% of the S&P 500, and the total is about 30% and it's actually more today than it was the peak in 2000 when we had that tech bubble burst," Crossmark Global Investments CEO Bob Doll said during an interview with FOX Business.

ARM CEO TALKS GROWTH AS STOCK ROCKETS

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| MSFT | MICROSOFT CORP. | 401.14 | +7.47 | +1.90% |

| AAPL | APPLE INC. | 278.12 | +2.21 | +0.80% |

| NVDA | NVIDIA CORP. | 185.41 | +13.53 | +7.87% |

APPLE STORE IN CALIFORNIA DECIMATED BY MASKED THIEF

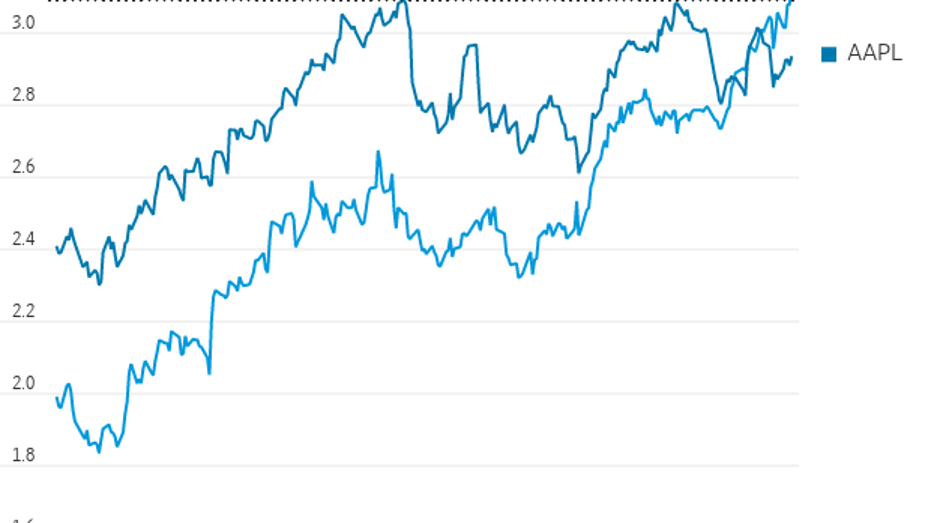

To Doll's point, Microsoft displaced Apple as the world's largest company as its market cap moved above $3 trillion on Friday, compared to the iPhone maker's $2.9 trillion, as tracked by Dow Jones Market Data Group.

Microsoft CEO Satya Nadella speaks during the OpenAI DevDay event Nov. 6, 2023, in San Francisco. (Justin Sullivan/Getty Images / Getty Images)

Under CEO Satya Nadella, Microsoft is the first U.S. company to close with a market value of $3.124 trillion. The company is coming off a record year, pulling in $62 billion in revenues driven by cloud computing and artificial intelligence.

WHAT IS ARTIFICIAL INTELLIGENCE (AI)?

"We’ve moved from talking about AI to applying AI at scale by infusing AI across every layer of our tech stack," Nardella said during a January earnings call.

Apple vs. Microsoft (Dow Jones Market Data Group )

Communication, technology and consumer discretionary stocks are the top-performing S&P sectors over the past three months, rising over 17%, 16% and 10%, respectively.

"Consider that over the past 12 months only three sectors have outperformed the SPX: Information Technology, Communication Services, and Consumer Discretionary. The first two have dramatically outperformed the index. We consider these sectors to be overvalued and favor investors trimming exposures down to our suggested neutral allocations for Technology and Communication Services and an unfavorable (underweight) allocation in Consumer Discretionary," Scott Wren, senior global market strategist at Wells Fargo Investment Institute, wrote in a note to clients.

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| XLC | THE COMMUNICATION SERVICES SELECT SECTOR SPDR FUND | 115.77 | -0.45 | -0.39% |

| XLK | TECHNOLOGY SELECT SECTOR SPDR ETF | 141.06 | +5.47 | +4.03% |

| XLY | CONSUMER DISCRETIONARY SELECT SECTOR SPDR ETF | 117.93 | +0.43 | +0.37% |

Both are outperforming the broader index, which has gained 5% this year and over 22% during the past 12 months as of Friday.

S&P 500